Toyota Excels in US Retail New Vehicle Industry

Among the three-volume leaders in the mainstream part of the new

vehicle industry – Chevrolet, Ford, and Toyota, the Japanese brand

is pulling away from the other two, based on S&P Global

Mobility new vehicle retail* registration data.

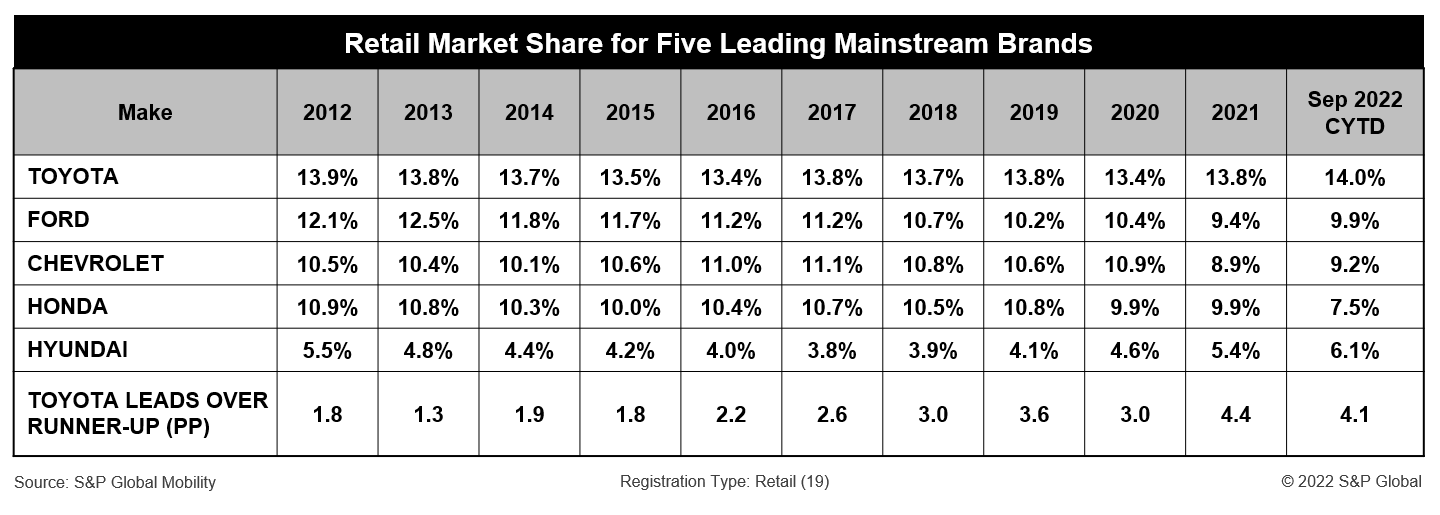

Toyota has been the retail market share leader every year since

2012 (see table below), and if its September 2022 CYTD retail share

of 14% holds through December, Toyota would lead for the 11th

consecutive year. Its 14% share also would be a record for the

brand – and the first time any brand has reached that level in the

past decade. Furthermore, Toyota’s 4.1 percentage point lead so far

this year over runner-up Ford is the second highest margin this

decade, surpassed only by the 4.4 percentage point gap last

year.

Four Toyota models (RAV4, Camry, Tacoma, and Highlander)

currently rank among the top 10 (of almost 400 nameplates on the

market) based on September 2022 CYTD new retail registrations,

including the #1 overall model (RAV4), #1 car (Camry), and #1

crossover (RAV4). No other brand has more than one model among the

top 10 this year.

Regarding brand loyalty, Toyota consistently ranks either second

(seven times in past decade) or third (four times) in the

mainstream space, surpassed only by Ford or Chevrolet or both. Its

current shortfall versus leader Ford of 2 percentage points is

slightly larger than its 1.4 percentage point gap for all of

2021.

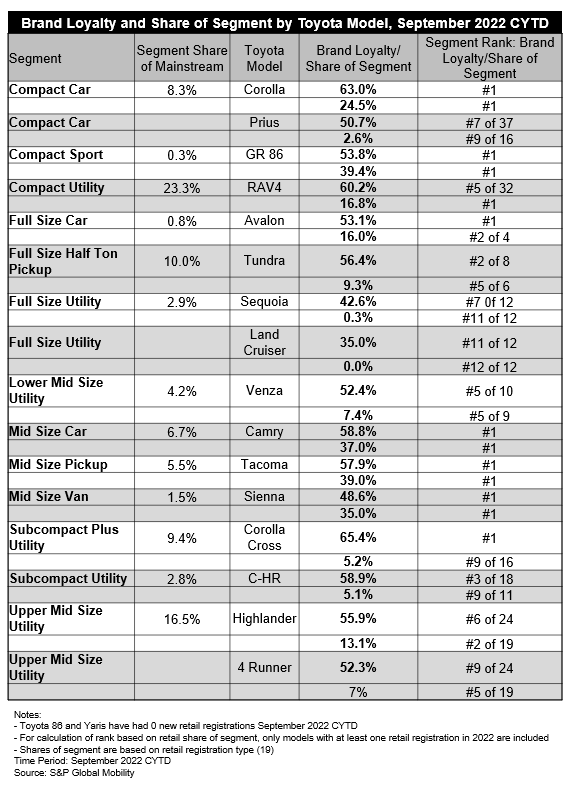

Toyota’s leadership position is reinforced by its segment-level

performance. Among the 14 segments in which the Toyota brand

competes, it currently ranks No. 1 in both retail share

and brand loyalty in five, including the Compact Car, Compact

Sport, Mid Size Car, Mid Size Pickup, and Mid Size Van Segments.

Together these five categories account for almost a quarter of the

mainstream space (22.3%). Further, in three additional segments,

including the Compact Utility, Subcompact Plus Utility, and Full

Size Car segments (with a combined mainstream share of 33.5%),

Toyota models rank No. 1 in either retail share or brand loyalty.

Put together, these eight segments in which Toyota leads in one or

both categories account for more than half (55.8%) of the

mainstream market, implying that Toyota now has a leadership or

highly competitive position in more than half of the mainstream

space. Toyota still lags in some key mainstream categories –

particularly full-size pickups and SUVs where the domestic brands

still dominate, and where Toyota has struggled to make a dent.

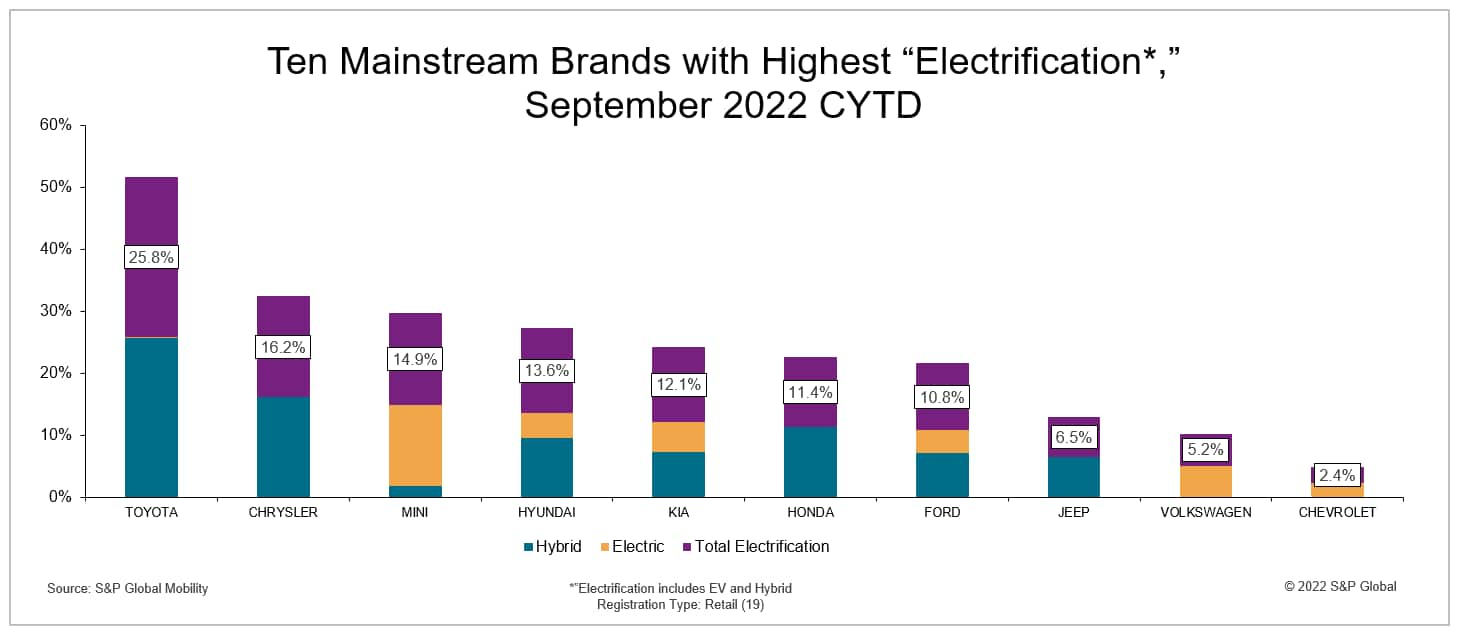

Toyota also leads the mainstream market in electrification (EV

and hybrid); its electrification share of 25.8% is almost 10

percentage points above runner-up Chrysler (see table below).

Admittedly, Toyota lags rivals Chevrolet and Ford in the

high-visibility EV space, as both those brands offer established

EVs with the Bolt and Mustang Mach-E, respectively, while Toyota’s

first EV, the BZ4X, is just now launching. But hybrids play an

important, though somewhat under-the-radar, role in alternative

fuel migration patterns: Hybrid households migrate to an EV at more

than three times the migration rate to EVs from ICE vehicles.

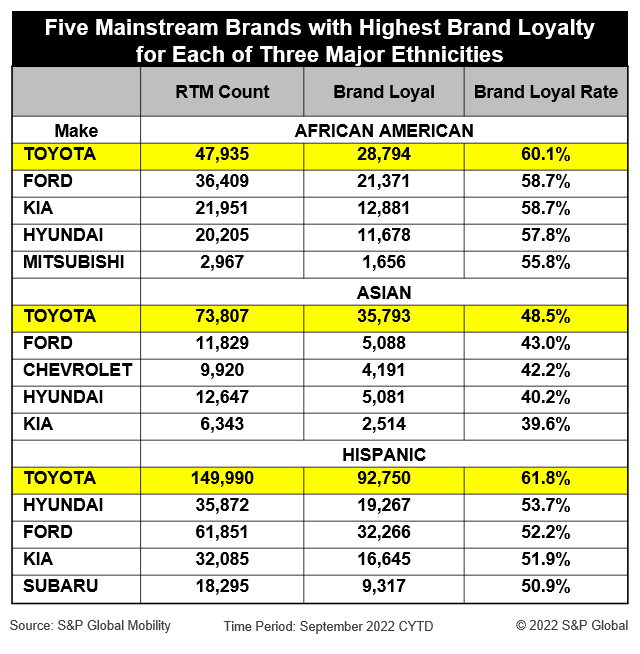

Lastly, Toyota clearly leads its mainstream competitors in

appealing to the three major ethnicities, an important achievement

given that African Americans, Asians, and Hispanics now account for

a third of all new retail registrations. As shown below, Toyota

brand loyalty among both African Americans and Hispanics surpasses

60% (the only mainstream brand for which this is the case), and

Toyota’s 48.5% brand loyalty among Asians is more than 5 percentage

points higher than that of runner-up Ford.

Given its record over the past several years, Toyota’s strong

positions in retail share, brand loyalty, and ethnic loyalty

support the claim that it is among the leaders, if not the

leader, in the US mass market new vehicle industry.

*Retail includes vehicles registered to individuals

——————————————————————————

Top 10 Industry Trends Report

This automotive insight is part of our monthly Top 10

Industry Trends Report. The report findings are taken from

new and used registration and loyalty data.

The November report is now available, incorporating October 2022

CFI and LAT data. To download the report, please click below.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.