Think the martech landscape is big? Here’s the size of the software industry overall

Around the 11 several years that I have been publishing the martech landscape, as it mushroomed from ~150 alternatives to ~10,000, I have observed several people respond to it as an anomaly. “What is it about promoting that spawns so a lot of program apps? Definitely no other profession has to offer with such sprawl!”

To which software package critique web page G2 responds in this report, “Hold my beer.”

Whilst there are surely dynamics certain to marketing that feed the frenzy of new martech startups, the truth is that martech is merely a section of a a great deal larger sized application revolution. Marc Andreessen named it “software ingesting the earth.” I phone it The Wonderful App Explosion. Computer software is all over the place (and, increasingly, almost everything is software program).

But particularly how many commercially packaged application apps are there in The Great Application Explosion?

Let us just take games and customer-oriented applications off the table. We know there are hundreds of thousands of these kinds of apps for cellular equipment on the Apple Application Store and Google Engage in Shop. It is reasonable to say which is a diverse kettle of fish than B2B program, this kind of as martech.

Very well, at least currently. Frankly, client and business software apps are driven by considerably of the very same underlying engineering. And you see escalating cross-pollination amongst all those domains. The consumerization of IT continues to be a major movement underway. I individually see similarities among creators on purchaser platforms and “makers” inside businesses leveraging no-code instruments. And if you imagine the hoopla of the metaverse — which will a single working day increase from the trough of disillusionment — the convergence of business and shopper encounters will blur even further more.

But for now, let us stick to a slim interpretation of how quite a few business software program applications are there in the earth?

The response: at the very least 103,528.

That is the amount of application items profiled on G2’s web site as of past week. It’s not a theoretical guesstimate. It is an empirical count — like the martech landscape, but spanning all business software categories.

I emphasised the phrase “at least” in front of that number for two factors:

1st, G2 acknowledges that they have not uncovered all of the company software applications out there nonetheless. My effect is that primarily in marketplaces outside the house of North The united states, there’s a ton even now to explore. Believe of China and Japan, for occasion.

Next, new software package startups keep becoming introduced. (You could possibly be mumbling beneath your breath, “Let’s see what the present-day economic climate does to that merry-go-round.” Place a pin in that caveat for a moment – I’ll occur again to it.)

In other words and phrases, that 103,528 amount is a reduce sure of the B2B software merchandise universe. The precise number is surely greater, and probably a lot larger. 150,000? 200,000? More?

G2’s database is surely continue to expanding, adding on typical 945 computer software products and solutions per month.

What about consolidation, you say? These numbers from G2 are inclusive of the truth that they’ve handled more than 760 merger and acquisition circumstances due to the fact January of this 12 months. So, certainly, consolidation is going on. But the paradox of simultaneous consolidation and enlargement in software package markets holds correct. It is not just martech.

Talking of martech, the people at G2 also shared with me the counts of 9,365 martech items and 1,488 adtech solutions in their databases. Mixed — which is how I have generally imagined of them — that is 10,853 madtech applications in total. Extra than what Frans and I came up with in our 2022 martech landscape release in Could.

Our plan is to share details among us and G2 to get a superset of all of them. But it’s wonderful to also have an impartial corroboration that, indeed, today’s martech landscape truly is on the magnitude of ~10,000 merchandise.

Is 2023 the 12 months of the Martech Cataclysm?

But let’s get again to that concern about the economy I dodged before.

No sugarcoating it. This upcoming yr or two is going to exert a ton of tension on the present martech landscape. Funding will be more difficult to occur by, and at considerably a lot more modest valuations. Advertising and marketing departments are going to have tighter budgets and turn out to be a lot tougher clients when it arrives to thinking about and negotiating martech purchases. This is the to start with time in over a decade of exponential martech development that the market is going through a truly formidable financial setting.

Definitely, this will outcome in quite a few more acquisitions of scaled-down martech fish by more substantial martech fish, as effectively as the non-public fairness crowd betting on the other side of this cycle. But additional painfully, there will be an escalating range of early-stage martech ventures that only phone it quits just after failing to both protected their next funding spherical, discover a ready acquisitor, or rebalance their functions to profitability.

My most effective guess? Up to 20% of the existing martech landscape could churn prior to 2024.

But it is only the churn amount of current martech sellers that I have a dark prediction about. As much as collective marketplace earnings goes, I think martech is going to continue to increase for the foreseeable long term. Perhaps not as rapid as it has been for the future pair of years. But in the significant picture, however very quick. For one basic explanation: the digital transformation of marketing and advertising is considerably from above, and it continues to be 1 of the finest levers each and every enterprise on the planet has for successful and retaining prospects.

Primarily in the complicated instances ahead, wonderful martech will be very important to survival success.

Overlook valuations for now, which have been the semi-delusional yardstick of measuring martech ventures these previous several decades. Profits is the floor reality of sizing an marketplace. And I’m 99.9% specific martech earnings will mature yr-above-12 months for the relaxation of this decade.

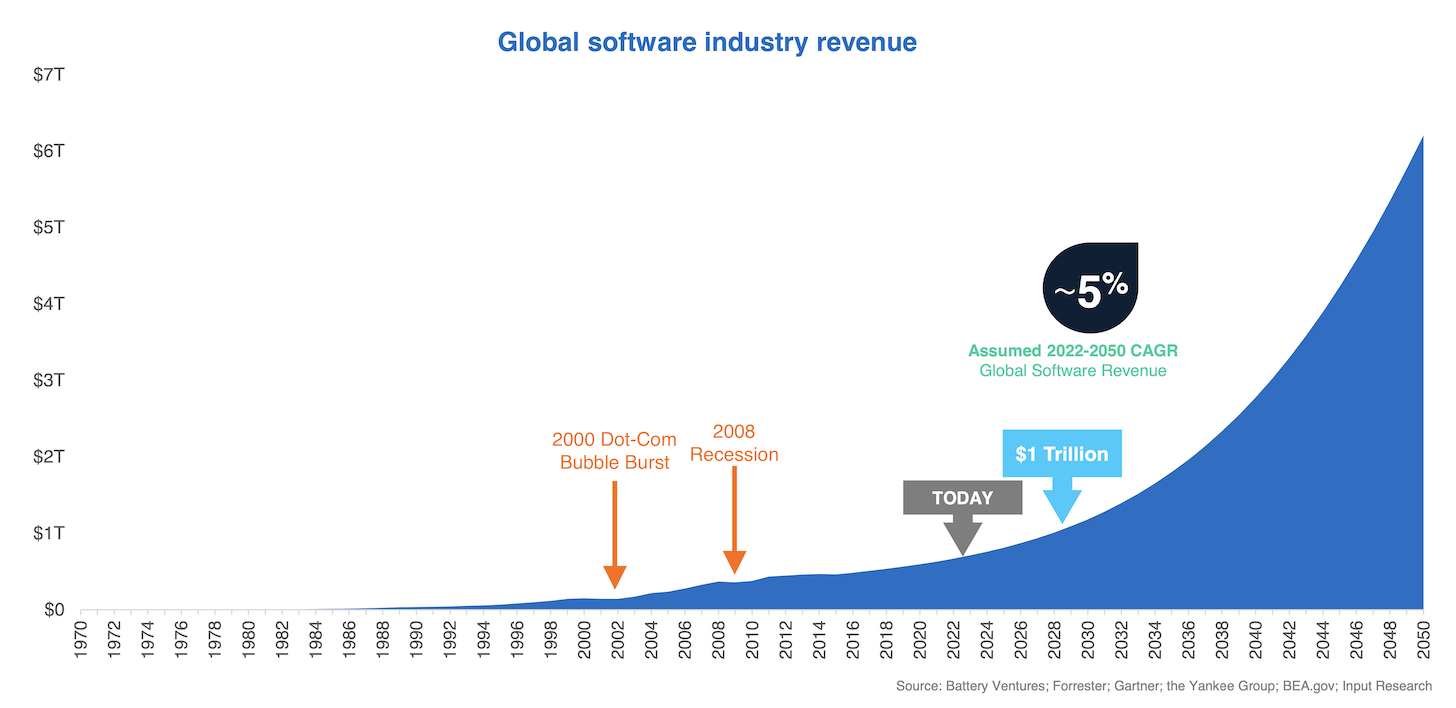

And to repeat the mantra of this submit: it’s not just martech. The complete computer software industry has massive progress ahead of it. The inspiring chart earlier mentioned from Battery Ventures (with my two annotations in orange) is equally an correct appear-again at software income progress about the earlier 5 decades, but also a relatively conservative extrapolation of regular compound annual development of program earnings for the subsequent two decades.

Two matters pop out quickly from that chart:

Initial, holy cats, the dimension of what the software package business is possible to increase to by 2050 dwarfs wherever we are today. “Software eating the world” is computer software getting around a lot more and far more of just about every facet of the economic system. Throughout the world GDP in 2020 was ~$85 trillion. By 2050, it is predicted to be ~$165 trillion. It is truly not that mad to imagine of program generating up a mere $6 trillion of that, or ~3.6% of complete GDP.

2nd, the Dot-Com Bubble Burst in 2000 and The Good Recession in 2008 hardly sign up as small dents in the upward slope of this mountain. That is not to trivialize the complications so a lot of faced in those people years. But placing these hurdles in point of view of the prolonged activity, the total trajectory of the program marketplace hasn’t been derailed by the ups-and-downs of macroeconomic company cycles. I believe that is heading to stay real for this generation and possibly the up coming.

All of which sales opportunities me to conclude that The Fantastic App Explosion will proceed through these subsequent couple of years. And on the following wave of restoration and enlargement, the development in new software program applications might quite effectively hit gentle speed ludicrous velocity.