Food delivery app asked to pay Rs 2,000 for Rs 3 extra GST in Hyderabad | Hyderabad News

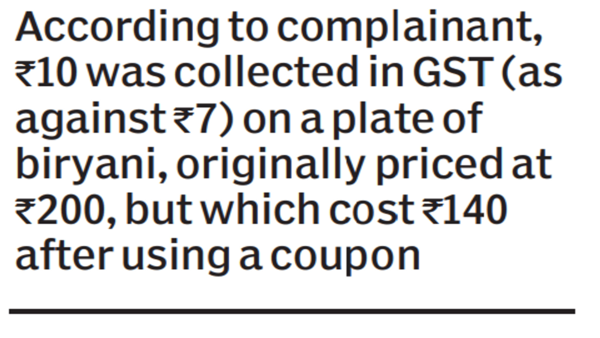

In accordance to complainant K Murali Kumar Reddy, astudent and resident of Himayatnagar, ₹10 was collected in GST (as from ₹7) on a plate of biryani, at first priced at ₹200, but which expense

₹140 after applying a coupon. The pe- tition was submitted from Swiggy Bundl Technologies Personal Minimal and Biryani Household, a cafe in Musheerabad. The commission also purchased them to fork out ₹1,000 towards expenses of the grievance.

The complainant purchased hen biryani from Biryani Household via Swiggy on September 8, 2019.

“As for every GST guidelines, the tax really should be charged on the discounted selling price of ₹140 which comes to

₹7. As per the GST Act, a GST TIN number on just about every bill has to be created. The reverse parties printed the GST TIN for only supply charges and misled the consumer by using added tax,” Murali alleged.

Swiggy mentioned: “We are not able to be held liable for the incorrect GST charging as the costs are decided by the retailers/cafe. We are shielded by the provisions of area 79 of the Data Technological know-how Act, 2000.

The alleged invoice which is connected by the complainant as annexure is not an invoice but basically an acknowledgement/get summary. Biryani House mentioned: “We supply foods to Swiggy at agreed price tag. The alleged tax collected is purely a small business affair of Swiggy.”